We support consumers as record breaking inflation rates hit home

Price inflation is hitting consumers hard all across Europe with new figures for the Eurozone putting it at a record breaking 5%. Yet this 5% average hides significant disparities between countries. Portugal has a relatively low 2.8% rate, Italy is at 4.2% whereas Spain and Belgium have much higher rates of 6.5% and 5.71% respectively. Meanwhile in some Baltic states, levels have reached a staggering 10.7% in Lithuania and 12% in Estonia with serious impacts felt on food prices.

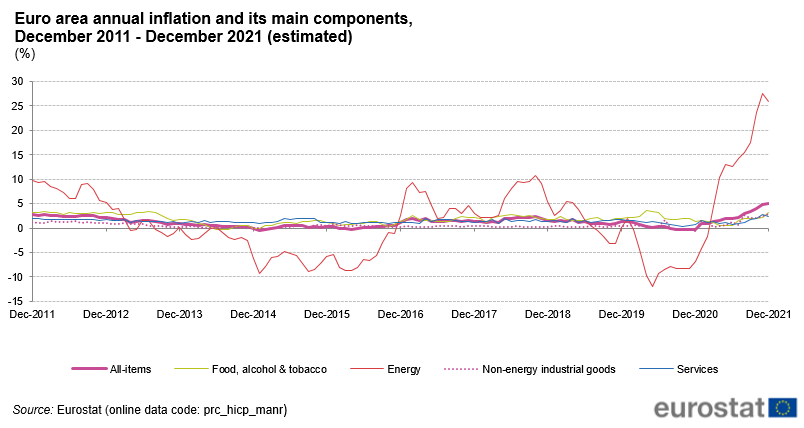

The graph above shows how inflation rates have risen over the last ten years. It is based on the Index of Consumer Prices which is used in the Eurozone to measure consumer price inflation. This is made up of the actual prices of everyday things like food, broadband, train travel, clothes, childcare and fuel. When prices inflate, consumers’ money simply doesn’t go as far and so behaviours and buying power change.

The graph above shows how inflation rates have risen over the last ten years. It is based on the Index of Consumer Prices which is used in the Eurozone to measure consumer price inflation. This is made up of the actual prices of everyday things like food, broadband, train travel, clothes, childcare and fuel. When prices inflate, consumers’ money simply doesn’t go as far and so behaviours and buying power change.

What is pushing up inflation?

Soaring energy prices driven by high, post-Covid demand, geopolitical disagreements and unreliable supplies are driving much of the broader rate rise. The latest Eurostat figures put the energy inflation rate at 26%, compared to other components such as food, alcohol & tobacco (3.2%) and services (2.4%). However, energy costs affect much more than just heat and light in homes, expensive energy means higher costs for manufacturing, transport and food production and of running shops, leisure facilities and restaurants – all of which can get passed on to consumers. Add to this disrupted production supply chains and staff shortages as a result of the pandemic and an unsettled picture emerges.

Is high inflation here to stay?

There is hope that inflation has reached a peak and will drop closer to the European Central Bank’s medium-term target of 2% in the next few months (which is still higher than the rates Europeans have been used to). Others are not so optimistic, with European Commissioner for the Economy Poalo Gentiloni saying that: “The factors driving high inflation in the European Union will decline, will fade, but probably not as soon as we expected.”

Regardless of debates over peaks and falls, when systemic, macro-economic factors push up prices like this, consumers are left in a precarious position as they make spending decisions to maximise the value of their money.

Euroconsumers support for consumers affected by high inflation

Like the majority of consumers, Euroconsumers member organisations are highly concerned about the inflationary prices. That’s why our teams are working hard to provide consumers with all the most relevant and accurate information about prices and how to maintain their purchasing power and avoid longer term problems:

- Our shopping comparators allow people to save on price and double down on quality.

- We publish explainers and videos that explain to people what’s going on in clear, concise terms. We explain the impact of inflation on different sectors of the economy, such as house rental prices.

- We also provide members with expert investment advice that allows individuals to hedge their investments against inflation with a variety of strategies.

- Our teams also help consumers choose the loans and mortgages that are most adapted to the current economic context. These are but a few examples of the concrete help and assistance we provide to persons who are looking to protect their money from losing its value.

Finally, we of course continue to monitor the situation and maintain direct contact with authorities to ensure that energy and other prices are kept at the lowest, most affordable price point possible. For as long as consumers are under the shadow of high inflation, we will continue to be vigilant in analysing its impact and offering direct practical support.