This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Making the repair reflex a reality: new consumer research for SHAREPAIR

At the moment, when a product breaks consumers opt for buying a replacement. This reflex is understandable – it is much easier to click to purchase for a new item than to find a repair shop or repair it yourself, or figure out how to claim on the warranty.

But a new project wants to change that reflex by making repair the obvious choice for consumers with broken tech or appliances.

Euroconsumers Belgian member Test Achats is part of SHAREPAIR, a major consortium funded through the European Regional Development Programme which is testing out a more consistent and reliable repair infrastructure for consumer products. The goal is for citizens to have viable, cost-effective alternatives to just scrapping and replacing broken products. In doing this, the project hopes to reduce the amount of waste from electrical and electronic equipment in Europe.

Consumers’ repair choices

One of the first outputs of SHAREPAIR is some valuable consumer insight from Euroconsumers research. Multiple factors influence consumer choices which means it’s important to understand why the current tendency to scrap and replace is so prevalent.

Euroconsumers survey of over 5,000 consumers in Belgium wanted to find out the extent to which consumers opt for repair and why they opt not to. Consumers were also asked about how and where they prefer to get products fixed and how much the presence of a warranty impacts choices.

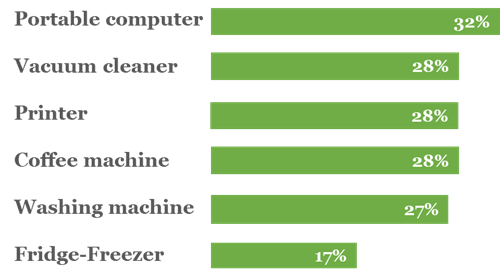

The survey asked about common large and small household appliances and high tech devices: Laptop computers, printers, vacuum cleaners, coffee machines, washing machines and fridge-freezers. It found that:

1 Breakdowns are pretty common

Across the six categories of product, at least one of six consumers experienced a problem or breakdown in the last 2 years, either with the appliance they have now or a previous one in that category. The highest proportion of problems were with laptop computers and the lowest with fridge-freezers.

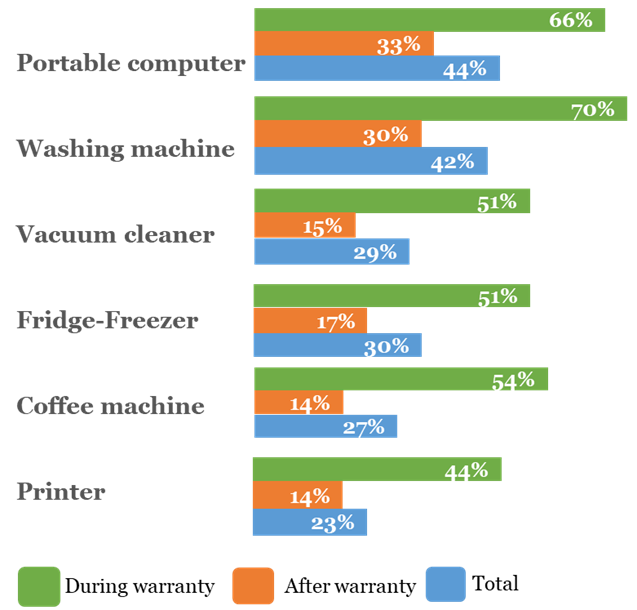

2 Warranties matter when making repair decisions

What is a warranty?

Warranties are a promise made by a manufacturer to the person who purchased the product that a refund, repair or replacement will be provided if the product is faulty or breaks down within a given time period. Generally, consumers can expect a warranty of two years on new devices and appliances.

Warranties proved to be important for consumers deciding on a repair. When products broke that were still under warranty, consumers were much more likely to get them repaired. The age of the appliance or device and the cost of it did not have a significant impact on the decision.

Across all devices, only the fact that a device was still in the warranty period appeared to play a significant role in the decision to repair. The biggest difference was seen for washing machines, where 70% of people opted for a fix during the warranty period, and only 30% did after the warranty period.

Consumers who had problems with devices or products they had bought new were asked whether it was still under warranty, and if they had repaired it….

3 But not all items under warranty get repaired

There are many reasons for not getting items repaired, even if the warranty makes it simpler. Consumers are busy people and so many make a pragmatic choice to continue to use the item (if the break does not prevent use), or decide that the time and effort to take a product back to a retailer or manufacturer is too much.

A tiny amount said they had not been able to get spare parts for the fix, others had been told the item was not repairable, or that it would cost too much. Even when a product is under warranty, consumers might face costs if, for example, some parts are excluded from the warranty, or the warranty is refused or if they’ve lost the original paperwork.

4 Cost is key for items out of warranty

When consumers decide on repairs for items no longer in the warranty period, cost is the overriding factor for all devices and appliances. Consumers reported that either the repair cost was too high outright, or that the device was no longer worth the repair cost.

5 Returning to the store is first choice for repairs

For products in warranty, taking a broken product to the place of purchase was the overwhelmingly popular option for consumers, followed by taking it to a representative of the brand. People are willing to give repairs a go themselves even when under warranty, particularly for high tech devices.

Once the warranty is up, there’s a jump in people attempting repairs themselves, with 60% having a go at a vacuum cleaner repair, and 29% having a try at a printer fix.

Generic repair stores are well used for high tech devices, with almost a quarter (23%) reporting that they had taken their laptop computer to one, and 13% bringing in a broken printer. Repair cafes are not widely used for products in or out of warranty – but these could be a vital community resource for easier repairs.

Changes across whole product lifecycle needed to make repair reflex a reality

The results show that for choosing repair over replacement to become second nature, changes are needed all across the entire product lifecycle and not just at the point of repair.

- First of all, consumers report that a high number a products are deemed ‘irreparable’ once they’ve broken, including recent purchases which breakdown under warranty. Consumers and the environment deserve much better than this. Manufacturers must step up and create durable products that offer longevity and value for money and don’t waste precious resources.

- Repairability scores and indexes could be helpful here to show people at point of purchase the extent to which the device is easily repairable. This could put pressure on providers to keep on improving the quality and durability of their products. Repair indexes can be based on criteria such as: ease of disassembly, availability of spare parts, cost of spare parts, the cost of these parts, the information available for repair etc. Other ideas include ‘longevity scores’ or visible commitments to lengthy product lifetimes to encourage consumers to buy durable products.

- We also learnt that warranties are an important factor in repair choices. Governments could follow the lead of Belgium where consumers now have the advantage of stronger rights. New rules have put the onus on retailers to demonstrate that any problem was not already present when the product was purchased, this has strengthened the hand of consumers who might previously have been fobbed off with excuses for not replacing or repairing items.

- Thirdly, the cost of repair is an important factor especially versus the value of the product, suggesting that creative ways to bring down repair costs particularly for lower value products are needed. The survey has shown that people are willing to give repairs a go themselves. This could be enhanced by projects . Euroconsumers is already involved in projects like CircThread which could empower people to make their own repairs. CircThread provides information on spare parts and repair guides through a digital platform. Consumers upload details about their products and their experiences with breakdowns and repair.

- Generic repair stores are widely used for tech repairs, and could have potential to expand and build a reputation for repairing other products. Repair cafes are not widely used yet but these could be a vital step towards easier repairs.

SHAREPAIR is one of a series of projects that Euroconsumers members are involved in as they test out practical solutions that will accelerate the shift to a more circular economy that is Approved by Tomorrow. Euroconsumers is also advocating for a meaningful European Right to Repair to embed rights that will help end the damaging cycle of waste and premature obsolescence.

This survey of 5020 Belgian consumers was carried out through in May 2022 via an online questionnaire, the sample was weighted to represent the distribution of the general Belgian population in terms of gender, age (between 18 and 74 years old), educational level and geographical regions.