Euroconsumers Affordability Barometer shows a bleak outlook for consumer finances

The Consumer Affordability Barometer

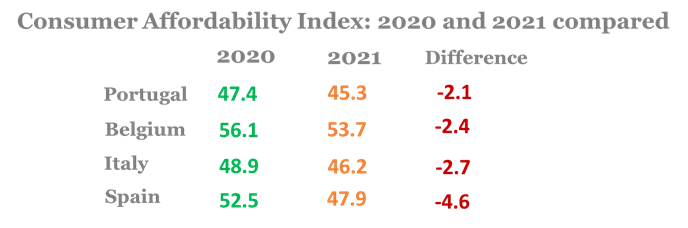

The fourth annual Euroconsumers Affordability Barometer is out with some sobering results. The survey of all four Euroconsumers member countries measures the financial affordability of consumers’ everyday needs and activities. Sharp drops in the index show consumers are facing increased costs in housing, mobility, food and health as rising inflation, the lingering Covid-19 crisis and energy prices hit home.

Consumers were also asked for their predictions for household income and outgoings over the next year. The survey took place at the beginning of 2021, prior to the war in Ukraine and the knock on effect on energy and food prices. At that time, respondents already felt that things would get worse, and we can expect that if asked now, their views would be even more pessimistic.

What the Euroconsumers Barometer measures

In total, 15,282 consumers aged between 25 and 79 years were surveyed across Belgium, Italy, Portugal & Spain. Results were weighted to be representative of national demographics such as age, gender, location and education level.

The survey asked consumers how they coped with financial outgoings like food, transport, health costs, education, leisure and general household bills and expenses over the last year, and how they think they will fare in 2022. They were also asked how important each area is for the quality of life of their household.

From these results, an index between 0 and 100 was created, showing the ability of households to meet their main expenses. The higher the index value, the easier the situation of households and vice versa.

As the survey has been repeated each year since 2018, Euroconsumers is building a clear picture of household experiences and expectations over the years.

National insights from the 2021 Euroconsumers Barometer

- In Belgium, the Consumer Affordability Barometer decreased for the first time since Euroconsumers began conducting this survey in 2018. The forecast for 2022 by consumers is also bleak – 43% of consumers expect a worse financial situation in 2022 and only 8.5% expect things to improve.

“43% of Belgian consumers expect a worse financial situation in 2022”

- The proportion of households in serious financial difficulties have increased by 1.4% this year, while households with no financial difficulties have decreased by 3.3%.

- In Italy, the Barometer measured a marked deterioration in households’ ability to meet their main expenses compared to 2020. Year-on-year, the index dropped 2.7 points from 48.9 in 2020 to 46.2 in 2021, making 2021 the lowest value since the index began in 2018. The specific items of expenditure that created the most problems were: car expenses (55% in difficulty), dental care (50%), travel and holidays (47%), medical/specialist visits (47%) and bills (45%).

- In Portugal, the Barometer has lost 2.1 points between 2020 and 2021, and consumers forecast that it will drop a further point in 2022. We also see that only 7.6% of families found it easy to save money, while more than 72% of households had difficulties in putting some money aside. The largest increases in family expenditures were found in the sector of mobility, followed by housing (including energy bills) and food.

- A sharp drop was also experienced in Spain, where the 2021 results for 2021 have fallen lower than the 2019 levels. The expenditures that have increased the most are housing (up 10.9%), mobility (up 8.6%) and food which saw a rise of 8.1%). The proportion of Spanish households “in serious economic difficulties” has risen 1.6% since last year, putting the total at 8% of all households. Meanwhile, the percentage of households without financial difficulties has decreased by just 1 point this year.

“Only one in three Spanish households can live in a financially comfortable situation”

- Forecasts for the current year 2022 by Spanish families are not very promising and 37% of families expect things to be even worse than 2021, compared to 17% who expect it to be better.

The impact of the energy crisis

Even before the Russian invasion of Ukraine squeezed energy supplies, a series of circumstances were putting extreme pressure on energy prices. Renewed economic activity post-Covid19 has triggered high demand for energy and unexpected temperature fluctuations and a lack of predictable wind power have led to erratic demand and supply.

The direct impact on consumers was obvious in the Barometer results across all countries. In Belgium, electricity, gas and water costs rose by 8.2% and car-related expenses including fuel saw an increase of 6.8%. Looking at Spain, expenditures that had created the most difficulties in terms of affordability were: gas, electricity and water up 13.2%, heating up 9.2% and car-related expenses up 8.9%.

In Portugal, the costs of running a car also caused difficulties, with 64% of people saying they found it difficult financially. Energy costs in the home were also high on the list, with 45% facing difficulties. In Italy, we see the same pattern, 53% of consumers there had difficulty affording gas, electricity and water, and 32% reported other types of heating sources were causing difficulties.

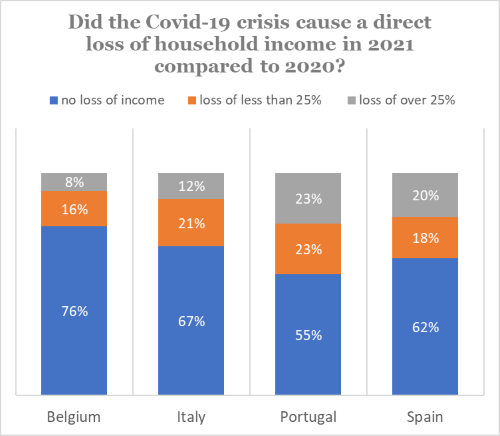

The Covid-19 crisis continues to impact incomes

Even as societies and economies open up, the impact of the Covid-19 pandemic on jobs, schooling and supply chains continues. This puts pressure on incomes and outgoings, with many households reporting direct loss of household income in 2021 compared to 2020. The table below shows how this looks across the four surveyed countries.

Covid-19 has continued to have a significant impact on the Spanish economy during 2021, with 38% of households reporting a loss of income during 2021, and 20% a significant loss of over a quarter of their 2020 income, compared to 62% of households who managed to maintain their income.

Portugal saw the biggest overall proportion of households reporting a loss of income, with 46% in total facing a reduction, and almost a quarter (23%) facing significant losses of more than 25% of their income compared to 2020.

“One in three Italian households saw their income fall compared to 2020 as a direct result of the Covid-19 crisis”

The reduction in income is due in almost half of the cases (46%) to a period of unemployment and in 39% of cases to a reduction in salary or income from work.

Belgium households tended to fare better, with only 24% reporting that Covid-19 has caused a loss of income, and only 8% experiencing a significant loss in their income, that would affect their capability to access services, products & activities . On the other hand, the vast majority of households (76%) have not been financially affected by the crisis, or have been affected less with 16% suffering reductions of their income lower than 25%.

Support for consumers in financial crisis

The current global economic trends, war in Europe, growing energy crisis, rising inflation and the lingering Covid-19 situation are creating major challenges for consumers. The Euroconsumers Affordability Barometer provides an evidence base that confirms consumers’ general financial capacities are deteriorating and confidence that things will improve is waning.

Consumers will need all the help they can get to face the current multiple crises. This strengthens Euroconsumers and its member organizations’ resolve to keep working to improve consumer’s lives and ensure they are not left behind as the social and economic shockwaves continue.